This material is designed and intended to provide general information in summary form on legal topics, current at the time of publication, for general informational purposes only. This is not legal advice.

Who is an arts worker?

The term “arts workers” encompasses a hugely diverse range of workers. People working in the arts may be visual artists, they may work in the literary arts or the performing arts of dance, music, and theatre. There are even more types of workers when you consider all the roles supporting the arts including arts administration, production crews, ticket sellers, ushers, spruikers, and festival workers. The length of the list of arts workers is only confined to the limits of human creativity.

Working out your rights and entitlements in the arts can therefore be like finding your way in a labyrinth. Because of the diversity in the nature of work performed, there are many workplace laws that govern working in the arts.

Here are some questions and answers to common issues for arts workers.

Am I an employee?

Workers in the arts are commonly engaged as either employees or independent contractors. It is important to understand the nature of your engagement as a worker because there are different legal rights and obligations depending on the working relationship. For example, some workers are entitled to minimum rates of pay and leave, while others set their own pay and must organise their own leave arrangements.

How can you tell which is which?

Employees work in someone else’s business. The employer controls how, where and when they do their work, and pays them a wage or salary. Employees are entitled to superannuation and they have payroll tax deducted from their pay by their employer. Most employees are entitlement to minimum wages and conditions from an award.

Examples: Full-time arts administration worker, an usher at a theatre, casual sound engineer at a theatre company, or a food and beverage attendant in an outdoor bar at a festival or event.

Independent Contractors work for themselves and are their own boss. They are free to set their own fee for the work that they perform and have control of when and how they work. They should have an ABN, invoice for their work, and organise payment of their own taxation. They may invoice for completion of a job rather by the hour. There is no minimum rate an independent contractor can rely on, rather they set their rates according to the free-market.

Examples: a visual artist engaged to paint and complete two large murals, or a musician playing a three hour set at a particular event.

Sometimes the true nature of the relationship will be obvious but sometimes a more fulsome analysis of all the circumstances of the working relationship is required. There are a full range of factors to be considered in determining whether a worker is an employee or an independent contractor.

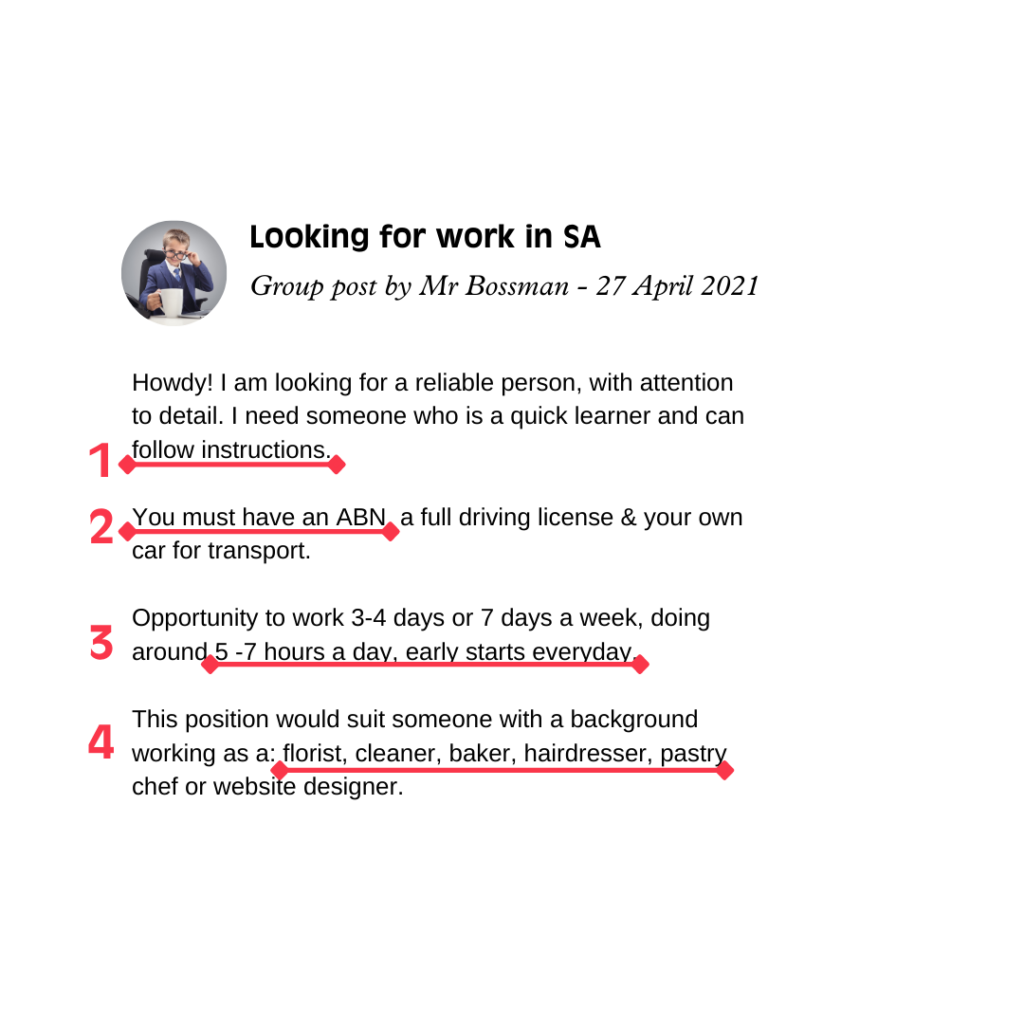

Some employers treat their workers as independent contractors when they are really employees. For example, the employer might require the workers to have an ABN and invoice for their work, yet they are paid by the hour and directed to work certain days and times at the employer’s discretion.

It is unlawful for an employer to misrepresent employment as an independent contracting arrangement. This is known as sham contracting and it is against the law.

If a worker is in a sham contracting arrangement, they may be entitled to claim unpaid wages, superannuation and leave entitlements, and the employer may be required to pay a penalty for breaking the law.

If you think you are in a sham contract arrangement you should contact the WWC for advice.

Where do employees find their minimum entitlements?

Awards or modern awards are legal documents that outline employees’ minimum pay rates and conditions.

There are more than 120 awards that cover most people who work in Australia. Awards apply to employers and employees depending on the industry or occupation they work in and the type of work they perform.

Here are some of the Awards that might apply to workers in the arts and some examples of the types of work they cover:

Amusement, Events and Recreation Award 2020:

Animal attendant, Ride attendant, Tour guide, Customer Service Officer, Meet and Greet/Concierge, Photography Attendant, Host/Presenter, Admissions/Entrance attendant, Usher, Ticket seller, Security Officer, Receptionist, Programme seller, Cashier

Broadcasting, Recorded Entertainment and Cinemas Award 2020:

Television Broadcasting, Radio Broadcasting, Cinema and film production, screen actors, Musicians for film and TV, Motion Picture Production, dancer, mime artist or puppeteer

Graphic Arts, Printing and Publishing Award 2020:

Creation of designs, concepts or layouts used in the advertising, marketing of commodities or services, commercial and industrial art including illustrations, borders, retouching of photographs, photographic reproportioning and lettering by hand

Live Performance Award 2020:

Producing, staging, audio/visual, presenting, performing, administration, programming, workshops, set and prop manufacture, operatic, orchestral, dance, erotic, revue, comedy, or musical performances; includes sale, service or preparation of food or drink; and selling tickets

Textile, Clothing, Footwear and Associated Industries Award 2020:

Fashion and Textile design

Travelling Shows Award 2020:

Travelling shows including the operation by an itinerant employer of any stand, fixture or structure for the purpose of providing amusement, food and/or recreation, carnival, rodeo, community event or festival

For a full list of all the moderns award and to access your award you can visit: https://www.fairwork.gov.au/awards-and-agreements/awards/list-of-awards

If you need help working out which award applies to the work you perform call the WWC.

Do I get breaks? How long should my shift be? – Common conditions in Awards

For specific information about your rights and entitlements you should find out the modern award that covers your employment. However, there are some common conditions within the awards that might apply to your work in the arts:

Breaks: Most awards stipulate that workers get a break after five hours. Some awards provide for paid breaks and others provide that breaks are unpaid. Some awards also provide for rest breaks as well as meal breaks.

Casual loadings: Most awards will provide a loading of 25% for casual workers to compensate them for not receiving sick leave, annual leave or paid public holidays.

Penalty rates: Most awards provide penalty rates which provides a higher hourly rate of pay for working unsociable hours like public holidays, late nights or early mornings and weekends.

Minimum engagement: Minimum engagement periods require that the minimum shift length must be a certain number of hours. The minimum engagement period is usually between two and four hours.

Overtime: Many awards provide that you get paid extra after working a certain number of hours in a day i.e. more than 10 hours in one shift.

We re-iterate that the conditions outline above are general and if you would like advice on your award entitlements contact the WWC.

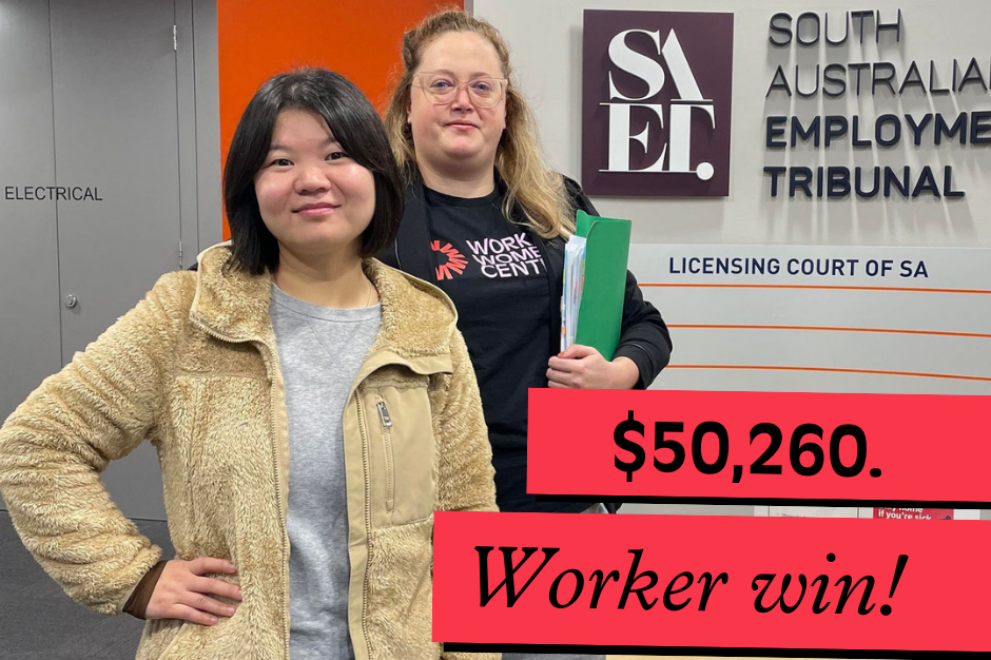

What can I do if I’m being underpaid?

Claim the money back! There is no lawful basis for an employer to pay you less than the minimum wage in your award or contract.

You can calculate what is owed and request they pay you the difference between what you were actually paid and what the minimum entitlement should have been.

You have up to six years to follow-up wages owed to you as a result of wage theft. You can make a claim to the South Australian Employment Tribunal.

Our Industrial Officers can give you advice about claiming wages if you think you may be owed wages from a current or previous job. We also have other fact-sheets that can assist with drafting a letter of demand to your employer.

Sexual harassment in the arts is NOT OK!

The #Metoo Movement was born out of the art world and we know sexual harassment is a problem across the industry. The Media Arts Entertainment Alliance, the union that covers many arts workers in Australia, conducted a survey of sexual harassment, criminal misconduct, and bullying in the Australian live performance industry. The results showed that 40% of the respondents had experienced sexual harassment.

Sexual harassment is any unwelcome conduct of a sexual nature. If a reasonable person would anticipate that the behaviour might make you feel offended, humiliated, or intimidated, it may be sexual harassment.

Sexual harassment can include:

- Sexually suggestive comments, insults, or “jokes” or imagery.

- Requests for sex or to perform sexual acts.

- Unwelcome touching or physical contact.

- Intrusive questions or comments about your private life or appearance.

- Inappropriate staring or leering.

- Sexually explicit or harassing messages (including text or social media), phone calls, emails, or images.

Sexual harassment does not have to be ongoing and can be one, single incident.

Some instances of sexual harassment can also be criminal offences, including physical or sexual assault.

Employers should have a policy for how to deal with sexual harassment in the workplace. It may involve a complaints process and an outline of how a complaint with be dealt with. Some workplaces may not have a policy and making a complaint of sexual harassment can be difficult. For example, making an internal compliant of sexual harassment may not be helpful in a small business, where the perpetrator is also the boss or the responsible for resolving complaints.

The Equal Opportunity Commission and the Australian Human Rights Commission can hear complaints about sexual harassment and victims can make claims for compensation.

The WWC Industrial Officers can give advice you further about sexual harassment in the workplace.

Random Questions from arts workers

Here are some RAQs (i.e. randomly asked questions) that we have received from people working in the arts:

Is it ok to be paid in tickets to shows, drinks, food, discounts, or other perks?

No. Additional perks are great, but these must be in addition to your minimum wages.

Can I have several jobs at the same time?

It is possible to work for different employers at the same time. However, some employers do not allow it, especially if the second job is for a competitor. They may have a policy prohibiting it. If that’s the case you should ask for permission before applying for that second job.

Is it ok to drink alcohol or take drugs at work?

No. Drinking alcohol or taking drugs at work can be characterised as gross misconduct and could result in termination of your employment, even if your supervisor or other staff are doing it and there is a culture condoning it. It is also a work health safety issue.

Is there are union for workers in the arts?

YES! The Media, Entertainments and Art Alliance (‘MEAA’) is the union that covers many workers in the arts sector. MEAA is the union for actors, entertainers, journalists and many more workers in the arts industry.

MEAA provides members with information on their workplace rights and advocacy to defend, promote and advance members’ rights at work.

MEAA membership also includes discounts plus benefits like journey insurance as well as professional development opportunities.

You can learn more about MEAA or join online here:

https://www.meaa.org/

Contact the WWC for specific information and advice about your rights and entitlements at work.

Where can I get advice?

If you are a union member, call your union.

If you are not a union member, then please feel free to call the Working Women’s

Centre on: 08 8410 6499

or using our toll free number: 1800 652 697.

You can also submit an online enquiry on our website.

https://wwcsa.org.au/contact-us/

Please be aware that we may not be in a position to respond to your enquiry within 24 hour’s, but we will advise you of the waiting period when you first telephone or email us.

Listen to the recording of our panel event ‘Working in the Arts’ featuring arts workers based on Kaurna land.

Our Panelists:

Gemma Beale

Gemma Beale

Letisha Ackland

Letisha Ackland

Emma Webb

Emma Webb

You’ll also hear from an Industrial Officer from the Working Women’s Centre about how you can protect your workplace rights in the Arts.